Press Releases

27 Jul 2023BE Semiconductor Industries N.V. Announces Q2-23 and H1-23 Results

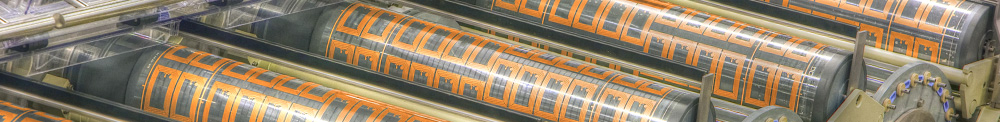

Duiven, the Netherlands, July 27, 2023 - BE Semiconductor Industries N.V. (the “Company" or "Besi") (Euronext Amsterdam: BESI; OTC markets: BESIY), a leading manufacturer of assembly equipment for the semiconductor industry, today announced its results for the second quarter and first half year ended June 30, 2023.

Key Highlights Q2-23

-

Revenue of € 162.5 million rose 21.8% vs. Q1-23 due primarily to increased smartphone demand for both high-end and mainstream applications. Down 24.1% vs. Q2-22 due to significantly lower demand for broad range of computing applications

-

Orders of € 112.6 million down 20.7% vs. Q1-23 principally due to lower orders for mobile applications post H1-23 ramp partially offset by increased automotive bookings from Asian subcontractors. Down 26.5% vs. Q2-22 primarily due to adverse impact of industry downturn on Besi’s end-user markets

-

Gross margin of 65.6% rose 1.4 points vs. Q1-23 and 4.6 points vs. Q2-22 due to more favorable product mix, net forex benefits and cost control efforts

-

Net income of € 52.6 million increased 52.5% vs. Q1-23 while net margins rose to 32.4% vs. 25.9% due primarily to higher revenue and gross margins. Vs. Q2-22, net income declined 30.4% due primarily to lower revenue levels

-

Total cash reached € 378.3 million at end of Q2-23 post capital allocation of € 289.1 million during quarter

Key Highlights H1-23

-

Revenue of € 295.9 million declined 28.9% vs. H1-22 principally due to lower demand for computing applications partially offset by increased shipments for high-end mobile end-user markets

-

Orders of € 254.6 million also declined 28.9% vs. H1-22 due primarily to general market weakness and lower orders for computing applications from IDMs and Asian subcontractors

-

Gross margin of 65.0% rose 4.5 points vs. H1-22 principally as a result of more favorable product mix, net forex benefits and overhead alignment with current market conditions

-

Net income of € 87.1 million decreased € 56.1 million, or 39.2%, vs. H1-22 primarily due to lower revenue, higher R&D spending and increased strategic consulting costs. Similarly, net margin decreased to 29.5% from 34.4% in H1-22

Outlook

Q3-23 revenue anticipated to decrease 20-30% vs. Q2-23 due to seasonal trends and ongoing market weakness with gross margin forecast to range between 62-64%

For the full version of our press release, please download the PDF file.